Generosity. For Good.

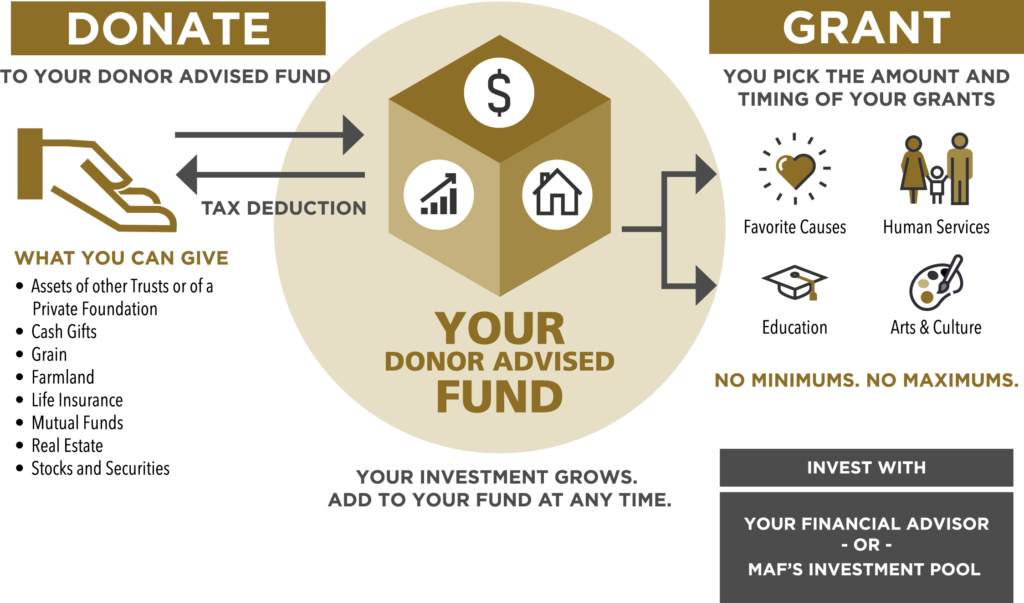

A Donor Advised Fund is an effective tool for charitable giving that provides benefits similar to a private or family foundation without the hassles. Donor Advised Funds minimize the worries and administrative burdens of grantmaking, so you can put your time and energy into what really matters: making a meaningful impact on the community, organizations and causes you value.

You can contribute to the fund when it is most convenient and receive a tax deduction for the contribution. What’s more, you can appoint others, such as children or grandchildren, to serve as advisors and share in your family’s tradition of giving and growing a legacy.

Who should consider a Donor Advised Fund?

Donors who want a simple and efficient way to manage their giving with the flexibility to support multiple charities over time. A Donor Advised Fund may also be appropriate as an alternative to a private or family foundation.

Whatever your giving goals might be, the Mankato Area Foundation can create a fund to help you make the most of your philanthropy.

What are the benefits of a Donor Advised Fund?

- A low-cost, flexible giving vehicle that is easy to establish

- Administrative convenience (e.g., consolidation of the management and tracking of tax receipts associated with charitable donations)

- Give complex or unusual assets at fair market value (e.g., real estate, closely-held stock)

- Option to work with your trusted financial advisor through our Investment Partners Program

- Opportunity to name the fund after you or in honor of a family member, a friend or an organization (e.g., the John Doe Family Fund)

- Experienced, professional staff with in-depth knowledge to help you achieve your charitable giving goals

- Involve children or other relatives in your philanthropy

- Choose if you would like recognition or anonymity for all of your charitable activities or on a grant-by-grant basis

- No annual minimum distribution requirements, unlike private foundations

How does a Donor Advised Fund work?

The first step is to meet with the expert staff at the Foundation to determine your current philanthropic approach and charitable goals for the future. You can choose to name a cause or philanthropic interest or have a broad scope of giving. We then work together to shape a grants program that meets those charitable objectives and interests.

DONOR ADVISED FUNDS

Generosity. For Good.

A Donor Advised Fund is an effective tool for charitable giving that provides benefits similar to a private or family foundation without the hassles. Donor Advised Funds minimize the worries and administrative burdens of grantmaking, so you can put your time and energy into what really matters: making a meaningful impact on the community, organizations and causes you value.

Contact Nancy for more information on establishing a fund.

Investment Partner Program

We will work with your trusted advisor.

We created the Investment Partners Program (IPP) specifically to enable donors to maintain existing investment relationships while benefiting from our community knowledge and philanthropic expertise. Through the program, professional advisors remain involved in fulfilling your charitable goals while the Foundation maintains an investment advisory role.

When to Start a Donor Advised Fund

- When planning to sell a private business

- During a “transition” phase in your life—empty nest, retirement or estate planning

- To receive a charitable tax deduction now, with the flexibility to make distributions in the future

- Because of a desire to give something back to your community now

- You want to leave a legacy for future generations

How to Get Started

- If you have a trusted advisor, talk to them about your philanthropic interests

- To participate in IPP, we ask that you have a goal of reaching $25,000 within the first three years

- To establish a fund, you sign a fund agreement with MAF and request your advisor manage the assets

- MAF and the advisor enter into the advisor’s standard investment services agreement, and the advisor manages the newly gifted funds according to MAF’s Investment Policy. The advisor will provide MAF with quarterly reports including asset allocation and rate of return

Telling Our Story

MARIAN ANDERSON

Home Is Where The Art Is

The next time you treat yourself to a stroll in downtown Mankato, you might notice an eye-catching sculpture of a young female painter on the corner of Second and Walnut. You might see folks taking their picture behind its open frame. You might stand behind the little bronze artist to see the world as she sees it—the movement of the city behind the still frame. Before you go, however, take a closer look. Do you notice anything out of the ordinary? Peer down at the artist’s palette. That’s where you’ll find it.

A mouse. Learn More

Work with our MAF team to find the right fit for you.

Learn how you can start to make an impact today.

For more information, please contact Nancy.