Building Your Legacy

Generosity comes in many forms, and it’s often the best way for you to support important causes that matter the most to you in your life. Through Planned Giving, you can create a permanent legacy that honors your interests and lets them live on forever.

The Mankato Area Foundation offers a variety of options to help reach your charitable giving goals.

Bequest by Will

The simplest way to make a lasting gift to the causes that are important to you during your lifetime is to create a bequest through your will or trust. By including information in your estate planning documents, you can easily establish a charitable fund (or add to an existing fund) at the Mankato Area Foundation that speaks to your philanthropic intentions. The bequest can be for a specific dollar amount, a percentage of your estate, or residue of the estate. MAF would be happy to provide you and your attorney with suggested language to include in your will or trust.

Life Insurance

Naming the Mankato Area Foundation as a beneficiary of your life insurance policy allows you to make a much larger gift than what you possibly could make during your lifetime. There are several different ways you can gift a life insurance policy. For example, you can irrevocably name MAF as the owner of an existing policy, deduct a calculated value of the policy as a charitable gift, or choose to name MAF as the beneficiary of a life insurance policy that you continue to own.

Charitable contributions made to the Mankato Area Foundation to pay any future premiums are eligible for a tax deduction in the year the gifts are made to MAF.

Retained Life Estate (Residence or Farm)

If you don’t plan to leave your personal residence or farm to family members, you could gift the property to the Mankato Area Foundation while receiving current tax benefits. By deeding property to MAF, you retain the right to live in the home or occupy the land without disruption for a term of years or until death.

While living on the property, you continue to be responsible for all routine expenses such as maintenance, insurance, and property taxes. However, when the retained life estate ends, the Mankato Area Foundation can use the property or proceeds from the sale of the property for your designated philanthropic purpose.

Retirement Plan Assets

Naming the Mankato Area Foundation as a beneficiary of your retirement plan, such as IRA, Keogh, 401(k), and 403(b), you gain the opportunity to avoid income and estate tax penalties while benefitting our region. These types of assets are the most heavily taxed; therefore, it may be more effective for you to transfer them to a tax-exempt organization, such as MAF. There are some restrictions on the types of funds that can receive such assets.

PLANNED GIVING

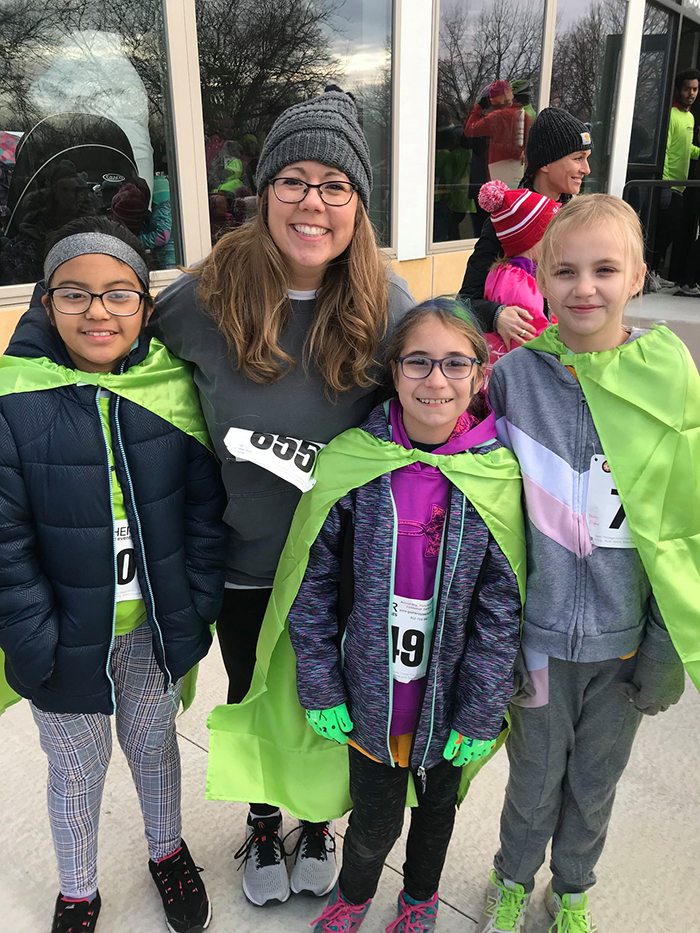

Giving Looks Good on Us

You can easily establish a charitable fund (or add to an existing fund) at the Mankato Area Foundation that speaks to your philanthropic intentions. A bequest can be for a specific dollar amount, a percentage of your estate or residue of the estate. MAF would be happy to provide you and your attorney with suggested language to include in your will or trust.

Contact Nancy for more information on how MAF can help you with your planned giving goals.

Gifts That Pay You Income

There are also many planned giving options that provide income to you while creating a charitable fund that will award grants in perpetuity to the causes you care about.

Charitable Gift Annuity

Charitable Gift Annuities at the Mankato Area Foundation are a way for you and/or your spouse (age 65 years and older) to receive a fixed and secure stream of income for life. You make a charitable gift (cash or securities) to the Mankato Area Foundation in exchange for MAF’s commitment to pay a fixed amount to you for the remainder of your lifetime. At the conclusion of the annuity, the remaining assets are contributed to your fund.

Charitable Remainder Trust

Making a gift to establish a charitable remainder trust allows you to support the region, retain an income stream and receive a substantial charitable income tax deduction. The trust pays either you or a designated beneficiary a series of fixed or variable payments for life or for a fixed term (not to exceed 20 years) or a combination of the two. You also receive an immediate charitable tax deduction for the present value of the gift the year it’s made. When the trust term expires, the remainder is then distributed into your fund.

Charitable Lead Trust

A charitable lead trust is the mirror image of a charitable remainder trust. Income from the trust is paid annually to the Mankato Area Foundation to establish and build your charitable fund. However, when the trust term expires, the remainder is distributed to you, or more typically, your children or other loved ones. Unlike a charitable remainder trust, it is not tax-exempt.

Fund Types

Community foundations are a creative and flexible means for community-based philanthropy. Donors who want to give back to “Main Street” have a myriad of options. The role of the Mankato Area Foundation is to assist donors in structuring their gifts so both the donor and the community benefit from their charitable generosity.

Learn More

Download Donor Advised Funds Brochure

WHEN TO CONSIDER PLANNED GIVING

- You want to pass on your values or simply make a difference in the region for future generations

- If you are without heirs or your heirs are already provided for

- When you no longer need your retirement plan or life insurance and want to designate the Mankato Area Foundation or other nonprofit organizations as the beneficiary

- There is a need to preserve cash, but you want to ensure causes you care about are supported over the long term

STEWARDSHIP

The Mankato Area Foundation carries out each donor’s wishes so you can have peace of mind knowing your intentions will be honored in the future. With a planned gift, you can partner with MAF to make a difference for generations to come.

Learn how you can started building your legacy today through Planned Giving.

For more information, please contact Nancy.